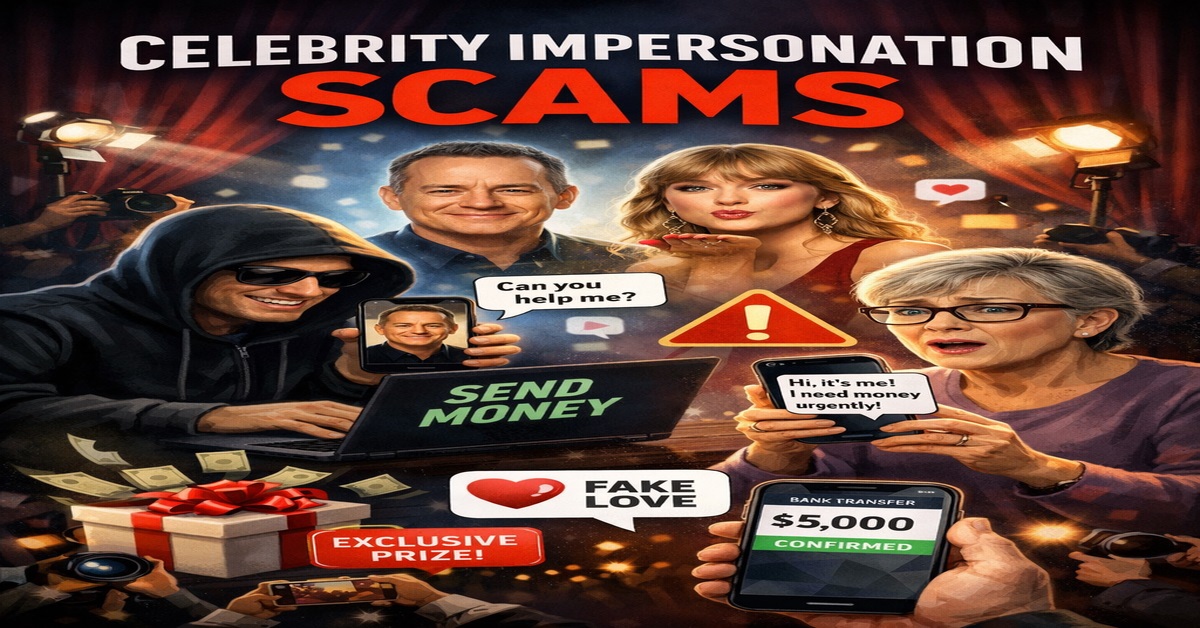

In today’s world, the internet has redefined how we talk, work, and handle investments. However, it has also caused the emergence of fraudulent activity, with fraudster websites being among the most concerning. Internet scammers specifically design fraudulent websites to deceive uncautious users while robbing them of their time and money as well as their emotional strength. Financial scams alongside romance frauds and business frauds are fundamental parts of how scam websites restrict people across the globe in their financial and emotional contentment. The following article delves into various scam types alongside specific indicators and receivers’ self-protection methods.

What Are Scammer Sites?

Scammer sites are fraudulent online platforms created to mislead users. These fraud sites present fraudulent accounts that use legitimate businesses, financial institutions or social media brands as duplicate appearances. Scammers use their sites with deception to steal money as well as personal information from victims.

Common forms of scam websites include those that promise high investment returns, fraudulent job portals, and phishing sites. For example, online investment scams frequently deceive people by offering them profitable opportunities to explore cryptocurrency alongside real estate investments and oil rigs. When victims hand over money to these scammers they disappear leaving behind financial harm and a great deal of disappointment.

Types of Scams on Scammer Sites

1. Investment Scams

Online investment scams are among the most widespread frauds you’ll encounter. Scammers lure people into unrealistic investment returns from fake businesses and fraudulent market opportunities. False credibility originating from testimonials along with falsified documents and crime syndicate pictures serves to build trust on such platforms. Avoid websites that provide “guaranteed” profit promises or use aggressive tactics to speed up your investment decisions. The losses from investment fraud typically destroy personal finances while people face extended struggles recovering their lost money.

2. Facebook Romance Scams

Romance scams are growing on social media sites like Facebook. Scammers build emotional bonds with their victims by creating profiles with attractive scammer images. They create emergencies to get money or important information once confidence has been built. Numerous victims experience financial exhaustion and heartbreak. Be sure to confirm the legitimacy of anyone you meet online, particularly if they start requesting money.

3. Oil Rig Scammers

One of the lesser-known but increasingly common scams involves so-called oil rig workers. Scammers pose as offshore professionals who state they need to work remotely because they cannot meet in person. These scammers demand monetary contributions for managing life emergencies and transportation expenses. Once victims discover they have been fooled it is already too late as the criminals have vanished entirely.

4. Phishing Scams

Online criminals create digital imitation websites that trick users into revealing their personal information by making fake representations of established financial institutions or retailers. Phishing sites ask for confidential information consisting of passwords together with credit cards resulting in data theft and financial deception.

How Scammer Sites Operate

Scammer sites work by earning your trust and pressuring you to make quick decisions. They often fake reviews, tweak photos to look authentic, and create phony certifications. In some cases, they even use detailed charts and professional designs to sell their lies.

Warning Signs of Scammer Sites

- Unrealistic promises: Offers of high returns with minimal risk should always raise a red flag.

- Urgency: A common tactic used by scammers is to create a feeling of urgency, pushing victims to act without second thoughts.

- Poor grammar and design: Many scammer sites have spelling and errors.

- Payment methods: Requests for wire transfers, cryptocurrencies, or gift cards are a common sign of fraudulent activity.

- Unverifiable information: Legitimate businesses provide clear contact details and proper certifications, which scammer sites often fail to do.

How to Keep Yourself Safe from Fraud

1. Research Thoroughly

Before engaging with any website, do a background check. Search for reviews, verify contact details, and check the domain registration date. Websites flagged for investment fraud or other scams often have user complaints online.

2. Avoid Sharing Personal Information

Be cautious when handing out confidential details, such as your bank details or ID, as scammers might exploit it for identity theft.

3. Recognize Fake Profiles

When you get unexpected friend requests, examine their photos and stories closely—Facebook romance scams usually involve profiles that look unrealistically perfect.

4. Verify Investment Opportunities

Always consult a licensed financial advisor before making any investment. Be wary of unsolicited offers or platforms that cannot provide proper documentation.

5. Use Online Tools

There are websites and forums where users share scammer pictures and scammer photos related to fraudulent activities. These platforms can be incredibly helpful for verifying the authenticity of a website or person. One such valuable resource is Scams Report, a site dedicated to empowering victims of scams and helping them take control of their financial futures. Scams Report’s commitment to transparency, integrity, and justice drives its ongoing efforts to combat financial fraud and provide support to those affected. Using these instruments can remarkably lower the risks of falling prey to scams.

What To Do If You’ve Been Scammed

- Report the fraud to your local authorities or cybercrime division.

- Contact your bank to block or reverse transactions if possible.

- Spread awareness by sharing your experience online to warn others.

Scammer websites are a threat to your financial security, privacy, and emotional health. Whether it’s fake investments or online romance scams, these frauds target your weaknesses. Protect yourself by staying informed, spotting the signs, and verifying online claims. If it appears too good to be true, it’s likely a scam. That is why always act cautiously, and contact Scam Report for free consultancy.

COMPLAINT NOW AND GET FREE CONSULTATION HERE

About Scams Report

The goal of Scams Report is to reveal and address financial fraud. With a focus on protecting investors, the platform provides:

- Comprehensive reviews of scam brokers and trading platforms.

- Assistance in recovering funds lost to scams.

- Educational resources to help individuals identify warning signs of fraudulent brokers.

By offering free consultation, Scams Report empowers victims to take action against unethical brokers.

Our Social Pages