Summary

Skyline Pro Broker claims to offer profitable trading opportunities, but research shows that it is not a regulated or licensed broker. Trusted authorities such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus) do not oversee the platform’s operations. Many users have reported issues with withdrawals, hidden fees, and misleading claims.

Exercise extreme caution if you are considering investing, and always verify a broker’s regulatory status before depositing any money.

Is Skyline Pro Broker Regulated or Legit?

No, Skyline Pro Broker is not a regulated broker. No significant financial authority has issued it a valid license. Your investment is very risky because unregulated brokers are not obligated to protect investors, separate client funds, or adhere to compliance regulations.

Recommendation: Invest only with brokers who have been approved by reputable authorities like the FCA, ASIC, or CySEC. Direct confirmation of registration information is available on the regulator’s website.

About Skyline Pro Broker

- Company Name: Skyline Pro

- Official Website: https://skylinepro.co/

- Registered Address: Manessestrasse 105, 8045 Zürich

- Regulatory Warning: Financial Conduct Authority (UK)

- Domain Blacklist Status: It seems there is no direct mention of this domain being on a blacklist.

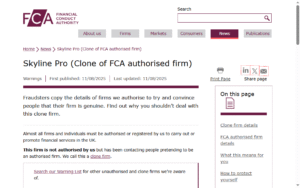

Warnings By Financial Conduct Authority (UK)

Cross-check these details carefully. Many fraudulent platforms clone legitimate websites or publish fake information to appear trustworthy.

Skyline Pro has a recent history of gaining public attention as a financial service with illegitimate aims. Despite presenting itself as a legitimate investment platform, it seems that Skyline Pro has swindled many investors into its trap through a professionally designed website and attractive offering. However, other visible red flags and regulatory warnings tell us Skyline Pro is not honestly engaging in a legitimate financial service, but rather scams potential innocent traders.

Regulatory Warnings and No Authorizations

One of the clearest indications that Skyline Pro may be illegitimate comes from the British Financial Conduct Authority (FCA). The FCA has warned the public about Skyline Pro and that Skyline pro was providing financial services in the United Kingdom without the required authorization, which means it is functioning illegally, and has no regulatory protection for funds that are deposited with the Skyline Pro in the collective moral proximity increasing underlying risk for investors. While Skyline Pro suggests that there are offices in Zurich, Switzerland, there is no registration to be found in the Swiss Financial Market Supervisory Authority (FINMA) database that is typical of a registered business, suggesting that claims about its business location and regulatory licensed business are deceitful and not intended to mislead traders.

Clone Company Scams

If there was any doubt before, Skyline Pro appears to be masquerading as a legitimate company. The real Skyline Financial Limited has publicly declared that it is in no way connected to Skyline Pro. This is simply a further indication that Skyline Pro is a clone site that is trying to piggyback on the name of and the reputation of a regulated company to lure unsuspecting customers into giving them money. Clone scams are becoming increasingly common, targeting customers who rely on the reputation of known brands in finance and never check to verify their legitimacy.

Skyline Pro demonstrates all of the hallmarks of a financial scam: fake regulatory claims, clone identity, and misleading promises. Customers should never have any dealings with this platform. Always check a broker’s regulated status with the regulatory authority before you deposit your hard-earned cash to ensure your safety.

Common Online Scams Similar to Skyline Pro

Scammers often use similar patterns across multiple industries. Here are the most frequent ones to watch for:

1. Forex and Trading Scams

Unregulated brokers promise high returns and later block withdrawals or manipulate trades.

2. Cryptocurrency Scams

Fake investment programs or phishing links steal funds and digital assets from investors.

3. Social Media Scams

Fraudulent ads on Facebook, Instagram, and Telegram promote quick profits or “guaranteed signals.”

4. Romance Scams

Scammers build emotional trust through dating apps and later request money for false emergencies.

5. Phishing and Identity Theft

Fake websites or login forms collect banking or personal information under the guise of verification.

How Scams Report Helps Victims Recover Lost Funds

If you’ve lost money to Skyline Pro Broker or a similar platform, Scams Report can guide you through potential recovery options.

Our Services Include:

- Free Case Evaluation: Review your situation and suggest a recovery path.

- Chargeback Assistance: Help initiate card disputes to reclaim funds.

- Crypto Recovery: Specialized support for victims of cryptocurrency fraud.

- Legal Guidance: Access to trusted partners for filing formal fraud complaints.

We provide personalized support and step-by-step help to increase your chances of recovering lost funds.

About Scams Report

Scams Report is an independent organization that exposes online investment frauds and helps victims recover lost money. Our experts have over a decade of experience tracking scam websites and maintaining a live database of fraudulent brokers.

We publish verified scam alerts, broker reviews, and recovery resources to protect traders worldwide and promote financial awareness.

FAQ

1. Is the Skyline Pro Broker a fraud?

Yes. Skyline Pro Broker operates without a verified license and shows multiple red flags, including withdrawal complaints and misleading claims.

2. Can I get my money back from Skyline Pro Broker?

Possibly. If you paid using a credit card or cryptocurrency, recovery options such as chargebacks or crypto tracing may be available. Contact Scams Report for a free review.

3. How do I confirm if a broker is regulated?

Check the regulator’s official website (e.g., FCA, ASIC, CySEC) using the broker’s license number. If no record exists, the broker is unregulated.

4. What are the dangers of unregulated brokers?

They can freeze your funds, alter trades, or disappear entirely with no legal accountability or protection for investors.

5. How can I protect myself against online fraud?

Only invest with licensed brokers, read independent reviews, and avoid platforms promising guaranteed profits or unrealistic returns.

Our Social Pages

Disclaimer: Online reports, user reviews, and publicly accessible data served as the foundation for this analysis. It is meant to be educational. Before investing with any broker, always do extensive research.