Summary

Bullbridge Auto Broker claims to offer profitable trading opportunities, but research shows that it is not a regulated or licensed broker. Trusted authorities such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus) do not oversee the platform’s operations. Many users have reported issues with withdrawals, hidden fees, and misleading claims.

Exercise extreme caution if you are considering investing, and always verify a broker’s regulatory status before depositing any money.

Is Bullbridge Auto Broker Regulated or Legit?

No, Bullbridge Auto Broker is not a regulated broker. No significant financial authority has issued it a valid license. Your investment is very risky because unregulated brokers are not obligated to protect investors, separate client funds, or adhere to compliance regulations.

Recommendation: Invest only with brokers who have been approved by reputable authorities like the FCA, ASIC, or CySEC. Direct confirmation of registration information is available on the regulator’s website.

About Bullbridge Auto Broker

- Company Name: Bullbridge Auto

- Official Website: NA

- Regulatory Warning: Financial Conduct Authority (UK)

Cross-check these details carefully. Many fraudulent platforms clone legitimate websites or publish fake information to appear trustworthy.

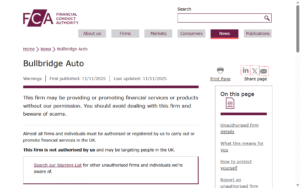

FCA Warning and Unauthorized Activity

Bullbridge Auto is being marked by the United Kingdom’s Financial Conduct Authority (FCA) as an unauthorized company. The financial watchdog reports that the firm is likely offering or marketing financial services without the legal authorization to operate in the UK. This is already a huge warning sign, as real financial entities are required to comply with very strict regulations.

No Customer Protection or Safety Net

All who are in contact with Bullbridge Auto are at risk of losing their money completely. The firm being unlicensed means that clients cannot resort to the Financial Ombudsman Service (FOS) for complaint handling, hence they are left without any official dispute resolution. What is more, the platform is not included in the ambit of the Financial Services Compensation Scheme (FSCS). If there is no FSCS protection, the investors have no means of getting compensation, no matter whether the company goes bankrupt or simply refuses to process their withdrawal requests.

High Risk of Financial Loss

Investors should prepare for blocked accounts, delayed responses, or even sudden loss of access to funds, all of which are indicators usually associated with scam operations. Besides, the non-availability of transparency, ambiguous contact information, and non-compliance with regulatory standards not only cast doubt but also reinforce the notion that the platform is unsafe.

Common Online Scams Similar to Bullbridge Auto

Scammers often use similar patterns across multiple industries. Here are the most frequent ones to watch for:

1. Forex and Trading Scams

Unregulated brokers promise high returns and later block withdrawals or manipulate trades.

2. Cryptocurrency Scams

Fake investment programs or phishing links steal funds and digital assets from investors.

3. Social Media Scams

Fraudulent ads on Facebook, Instagram, and Telegram promote quick profits or “guaranteed signals.”

4. Romance Scams

Scammers build emotional trust through dating apps and later request money for false emergencies.

5. Phishing and Identity Theft

Fake websites or login forms collect banking or personal information under the guise of verification.

How Scams Report Helps Victims Recover Lost Funds

If you’ve lost money to Bullbridge Auto Broker or a similar platform, Scams Report can guide you through potential recovery options.

Our Services Include:

- Free Case Evaluation: Review your situation and suggest a recovery path.

- Chargeback Assistance: Help initiate card disputes to reclaim funds.

- Crypto Recovery: Specialized support for victims of cryptocurrency fraud.

- Legal Guidance: Access to trusted partners for filing formal fraud complaints.

We provide personalized support and step-by-step help to increase your chances of recovering lost funds.

About Scams Report

Scams Report is an independent organization that exposes online investment frauds and helps victims recover lost money. Our experts have over a decade of experience tracking scam websites and maintaining a live database of fraudulent brokers.

We publish verified scam alerts, broker reviews, and recovery resources to protect traders worldwide and promote financial awareness.

FAQ

1. Is the Bullbridge Auto Broker a fraud?

Yes. Bullbridge Auto Broker operates without a verified license and shows multiple red flags, including withdrawal complaints and misleading claims.

2. Can I get my money back from Bullbridge Auto Broker?

Possibly. If you paid using a credit card or cryptocurrency, recovery options such as chargebacks or crypto tracing may be available. Contact Scams Report for a free review.

3. How do I confirm if a broker is regulated?

Check the regulator’s official website (e.g., FCA, ASIC, CySEC) using the broker’s license number. If no record exists, the broker is unregulated.

4. What are the dangers of unregulated brokers?

They can freeze your funds, alter trades, or disappear entirely with no legal accountability or protection for investors.

5. How can I protect myself against online fraud?

Only invest with licensed brokers, read independent reviews, and avoid platforms promising guaranteed profits or unrealistic returns.

Our Social Pages

Disclaimer: Online reports, user reviews, and publicly accessible data served as the foundation for this analysis. It is meant to be educational. Before investing with any broker, always do extensive research.