Summary

Ultras Asset Broker claims to offer profitable trading opportunities, but research shows that it is not a regulated or licensed broker. Trusted authorities such as the FCA (UK), ASIC (Australia), and CySEC (Cyprus) do not oversee the platform’s operations. Many users have reported issues with withdrawals, hidden fees, and misleading claims.

Exercise extreme caution if you are considering investing, and always verify a broker’s regulatory status before depositing any money.

About Ultras Asset Broker

- Company Name: Ultras Asset

- Official Website: https://ultra-asset.com/home.php

- Registered Address: Town Hall Chambers, 148 High Street, CT6 5NW Herne Bay, United Kingdom

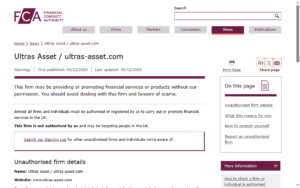

- Regulatory Warning: Financial Conduct Authority (UK)

- Domain Blacklist Status: It seems there is no direct mention of this domain being on a blacklist.

Warnings By Financial Conduct Authority (UK)

The number of investor complaints related to Ultras Asset is growing, and they are suggesting that the platform may not be legitimate. Users of the site have been indicating a lot of problems and patterns in their experience that are frequently associated with types of online financial fraud atmospheres.

Withdrawal Problems and Access to Your Money

There are many complaints from users regarding the inability to obtain their money. It’s easy to put your money into this site, and the site will take your deposit; however, users have trouble getting their money back after they have put it into the site. In most cases, users requesting their money back will have either a delay in getting their money or a denial of the withdrawal request.

Increased Requests for Additional Funds

Another serious concern raised by many investors is the constant pushing to deposit additional amounts of money into their accounts. Quite often, investors are encouraged to pay additional money for various reasons, such as to upgrade their account or top up the balance. These tactics may simply be ways of obtaining more money from users before ceasing all communication with them altogether.

No Openness Regarding Ownership, Licensing, or Regulation

The amount of verifiable information that Ultras Asset has to support its claim(s) of ownership, licensing or regulatory approval is inadequate. Furthermore, due to the absence of any form of regulatory oversight on behalf of the investor, it exposes investors to a much higher risk than would otherwise exist due to the lack of formal protection through dispute resolution.

Lost Funds to Ultras Asset Broker?

If you have already deposited money with Ultras Asset Broker, act quickly.

Fill out the form below to get a free consultation with fund-recovery specialists who can help trace and recover your money.

Is Ultras Asset Broker Trustworthy?

Ultras Asset Broker is not registered with any major financial regulator. Legitimate brokers must be authorised by bodies such as:

- FCA – Financial Conduct Authority (UK)

- SEC/CFTC – Securities and Exchange Commission / Commodity Futures Trading Commission (US)

- ASIC – Australian Securities and Investments Commission

- CySEC – Cyprus Securities and Exchange Commission

These regulators enforce strict rules, monitor financial operations, and protect customers.

Because Ultras Asset Broker lacks regulation:

- There is no authority overseeing its activities.

- Users have no access to compensation schemes or dispute resolution services.

- Funds are not insured, unlike regulated firms where clients may be covered by FINRA, SIPC, FSCS, or equivalent protection.

Trading with such unlicensed platforms carries a high risk of fraud and loss.

How Online Scams Usually Operate

Internet scammers use sophisticated tricks to build trust and then steal money. Below are common tactics associated with suspicious brokers like Ultras Asset Broker.

1. “Pig-Butchering” Romance & Investment Scams

Fraudsters may spend weeks or months gaining a victim’s confidence through dating apps, social media, or messaging platforms. Once trust is built, they encourage the victim to invest through a fraudulent trading platform like Ultras Asset Broker.

2. Fake Trading Platforms

Scam brokers often design dashboards that look real:

- Live-looking charts

- Fake profit spikes

- Manipulated account balances

They may even allow a small withdrawal at first to appear credible, then block all future withdrawals.

Common Red Flags

- Unsolicited contact: Calls, WhatsApp messages, or DMs offering investment opportunities.

- No regulatory licence: Or a fake/invalid licence number.

- Guaranteed returns: Promises of “risk-free” profits or fixed daily/monthly returns.

- Withdrawal problems: Sudden fees, taxes, or delays before releasing funds.

- Over-polished website: Professional design that hides the lack of real oversight.

- Fake testimonials: Made-up reviews or celebrity endorsements.

Steps to Take If You Were Scammed by Ultras Asset Broker

1. Cut Contact Immediately

Stop communicating with the broker or any associated person to prevent further manipulation.

2. Notify Your Bank or Payment Provider

Explain the situation and request:

- Chargeback (for card payments)

- Recall (for wire transfers)

- Reversal options (for e-wallets or crypto platforms)

3. Collect All Evidence

Keep:

- Screenshots

- Emails & chat logs

- Transactions

- Platform dashboard images

This helps recovery experts and law enforcement.

4. Report the Scam

Contact your local cybercrime authorities or financial regulator.

More reports help authorities track and shut down fraudulent operations.

5. Seek Professional Support

Fund-recovery specialists like Scams Report can guide you through chargebacks, crypto tracing, and legal steps.

FAQ – Ultras Asset Broker Scam Queries

Q1. Is Ultras Asset Broker regulated?

No. Ultras Asset Broker is not licensed by any recognised regulator, which makes it unsafe.

Q2. Can I get my money back from Ultras Asset Broker?

Recovery is possible in many cases if you act quickly. Chargebacks or crypto-tracing may help.

Q3. Why is Ultras Asset Broker considered risky?

Because it operates without regulatory oversight, offers guaranteed profit claims, and has multiple withdrawal complaints.

Q4. How can I know whether a broker is authentic or not?

Verify the licence number directly on the official regulator’s website (e.g., FCA, ASIC, SEC).

Q5. What should I do if Ultras Asset Broker blocks my withdrawals?

Stop depositing more money, collect evidence, contact your bank, and seek expert help.

About Scams Report

Scams Report is an independent organization that exposes online investment frauds and helps victims recover lost money. Our experts have over a decade of experience tracking scam websites and maintaining a live database of fraudulent brokers.

We publish verified scam alerts, broker reviews, and recovery resources to protect traders worldwide and promote financial awareness.

Our Social Pages

Disclaimer: Online reports, user reviews, and publicly accessible data served as the foundation for this analysis. It is meant to be educational. Before investing with any broker, always do extensive research.