Introduction

Trading using prop firm accounts has quickly become a top option for traders who want access to large amounts of capital with other people’s money. The idea of trading with prop firms can be very appealing, but many traders fall into traps that they can avoid, which can ruin their opportunity for success. No matter if you are entering a cheap prop firm, taking a special deal, or entering a prop firm contest, understanding the common failures traders make can mean the difference between consistently turning in profits.

1. Ignoring Your Rules and Conditions

Each prop firm will have some conditions to follow when you trade, such as daily loss limits, profit targets, leverage limits, etc. More traders lose because they ignore these limitations and conditions. Prop firm traders do not have the flexible plan they have trading with a brokerage firm. Prop firms simply limit the allowances for play and profits. Always take the time to read the rules and the terms and conditions of the firm before you step into your first trade.

2. Over-Leveraging and Trading with Emotions

In an attempt to reach their desired profit target quickly, many traders mismanage their complete leverage exposure. This is especially true in low-cost prop firm accounts where traders feel they are under pressure to show proof of competency within the account’s life span. Traders feeling pressured to prove competence resort to emotion-based decisions utilizing impulse, excess leverage, and insufficient risk management, resulting in the account’s failure. Consistent, thoughtful trading methods will always outperform impulse trade decisions.

3. Ignoring Market Conditions

Traders of prop firm accounts often trade with a rigid trading strategy without considering market circumstances. Trading in any market when volatility in the respective market conditions exists without sufficient plans to accommodate risk limitation, good boundaries will be breached quickly, and losses sustained. It is essential that if you are handling a funded trading account, you observe not only economic reports but trend reversion and liquidity flow on various instruments. As mentioned, a brokerage firm may offer some risk tools and utilities that some prop farms may not, so you must overcompensate with discipline and objectivity.

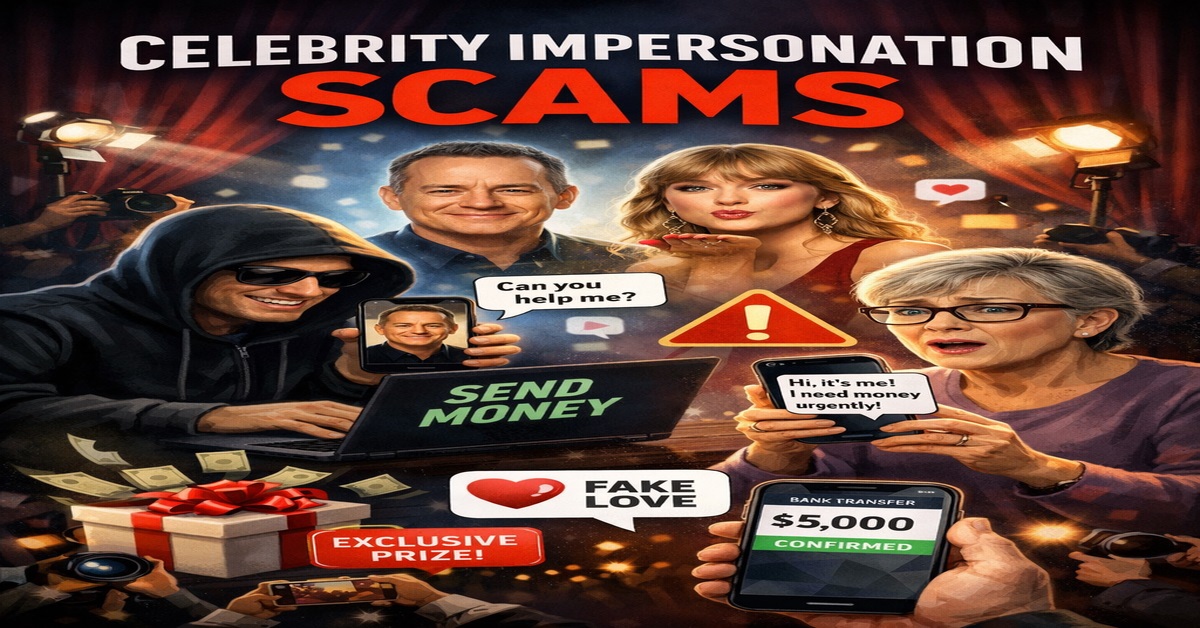

4. Falling for Unrealistic Discounts

It may be that discount codes of prop firms and promotional offers look very alluring, however not all of them are legitimate. Some unregulated companies use discounts as a way to get traders into poorly managed or sometimes even scam schemes. Always check the firm’s reputation, read customer reviews, and do not take the offers that sound too good to be true. Saving money at the beginning is of no use if the firm does not pay you the profits later.

5. Participating in Contests Without Preparation

A lot of traders do not hesitate at all to join prop firm contests, thinking they can easily make money by winning without having done any studies. These competitions may provide funded accounts as awards to the winning participants, but the stress of winning is what leads most traders to loss. Proper preparation, experience, and the right mindset are the key factors for one to be victorious in such competitions.

6. Failing to Manage Risks Properly

Risk management in trading is something that cannot be overlooked. Even the most precisely devised plan won’t help if risk management is neglected. Professional traders, for instance, apply stop-losses, do not change their position sizes, and avoid trading when their emotions are at their peak or low. Each trade must be regarded as a well-judged decision rather than a wager for fast profits.

Conclusion

Trading with a prop firm’s account can provide the opportunity for professional-level trading, but only if done by smart and responsible traders. Avoiding these mistakes not only protects your funded account but also opens up the road to success in the long term. Patience and discipline will be your best friends in mastering trading, whether you are searching for a cheap prop firm, using prop firm discounts, or participating in a prop firm contest to showcase your skills.

About Scams Report

Scams Report is an independent organization that exposes online investment frauds and helps victims recover lost money. Our experts have over a decade of experience tracking scam websites and maintaining a live database of fraudulent brokers.

We publish verified scam alerts, broker reviews, and recovery resources to protect traders worldwide and promote financial awareness.