In today’s trading world, traders are beset with two terms that are trending in the trading circle: prop firm and broker firm. Both can be important to the trading process, but they differ in how they function and support traders. Understanding the dynamics of Prop Firm vs Broker Firm and studying genuine prop firm reviews will help traders make smarter trading decisions while avoiding costly mistakes.

What is a Prop Firm?

Prop firms, also known as proprietary trading firms, give talented traders capital to trade financial products, such as stocks, foreign exchange, commodities, etc. Traders use the proprietary trading firm’s money to execute trades. The trader does not use their own funds and will earn a percentage of the profit they make. The prop firm gets a portion of all profitable trades, and the trader, in turn, has access to trading capital.

The prop firm structure has grown tremendously in popularity among independent traders who can trade but lack the trading capital necessary to start a trading account on their own. Many companies sell educational products, simulated challenges, and evaluation programs, so that the prop firm can examine a trader’s ability before funding an account.

How Does A Broker Firm Differ?

A brokerage firm acts as an agent between traders and the financial markets. Brokering firms provide traders access to trading platforms, execute trades on behalf of the trader, and occasionally provide advisory services. Traders use their own money in a broker account, in contrast to a prop firm, where the money being used is owned by the prop firm.

Broker firms earn money through spreads, commissions, and/or service fees instead of profit-sharing. As these broker firms are typically regulated by financial authorities, this adds another level of security and transparency for traders.

The Emergence of The Prop Firm Trend

In recent years, the prop firm model has evolved into an absolute powerhouse in the field of online trading. The prospect of trading with someone else’s capital and keeping a great portion of profits is what is attracting thousands of traders around the world. With the popularity of prop trading firms also comes a lot of firms popping up, some that might not be on the up and up.

The point is, before you sign up with any firm, you should do your due diligence and research the prop firm, read the reviews, etc. Legitimate firms like FTMO, MyForexFunds (which recently failed), and The Funded Trader aim for higher standards as a result of their focus on fair evaluation processes and clear payout structures.

In conclusion

Both prop and brokerage firms are vital components of modern trading environments, serving two different purposes while meeting different needs and risk tolerances. A prop firm, for example, provides a trader with capital and a profit-sharing opportunity if the trader can achieve consistent performance, while a brokerage firm may offer a more regulated environment for self-funded trading.

To ensure that you are getting into the right trading environment, always do your research, compare prop reviews, and try to find a transparent firm. The trading environment provides tremendous prospects only if you make thoughtful informed decisions that you can eventually turn into meaningful trading success.

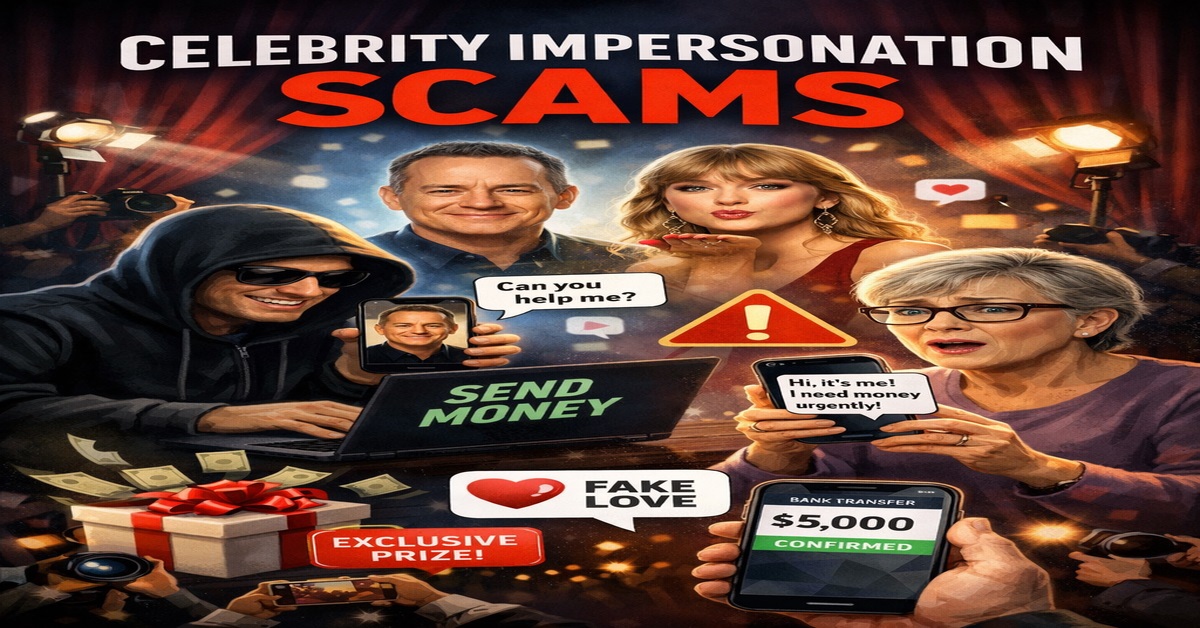

About Scams Report

Scams Report is an independent organization that exposes online investment frauds and helps victims recover lost money. Our experts have over a decade of experience tracking scam websites and maintaining a live database of fraudulent brokers.

We publish verified scam alerts, broker reviews, and recovery resources to protect traders worldwide and promote financial awareness.

Our Social Pages