The emergence of cryptocurrency has transformed the financial landscape and opened new opportunities for profit through digital assets as the world gains exposure to this expansion of crypto. With the growth of crypto, unfortunately, comes new sources of risk, specifically, this comes in the form of scams involving crypto investments. Scammers are growing increasingly clever, developing false sites, impersonating social media profiles, and pitching “investments” that can deliver nothing. For the ultimate safeguard of your money and to help make prudent and informed financial decisions, it is critical to understand how scams operate and how you can detect scams.

How Crypto Investment Scams Work?

Crypto investment scammers will often develop false platforms to provide the appearance of a legitimate investment or trading website. They will want to tell a story about everything from high returns on “guaranteed profits” or “no-risk” investments—major warning signs that consumers should notice. Many of these sites will claim to have sophisticated trading platforms, or even robots, that will double your money overnight.

Once wallet holders send their money to the site, the scam platform will show the investment to produce gains so that the victims feel comfortable with the trading or investment. When the victims request to take profits, dozens of roadblocks will arise, like “waiting on verification,” additional service fees for “KYC,” or accounts will be mysteriously suspended. More often than not, the scammer(s) will ghost the victims before they can do anything, usually leaving the victims with nothing and no recourse for injury.

Typical Types of Crypto Scams are

1. Fake Investment Platforms – These are websites that promise ridiculously high returns, and then disappear when they have taken in enough money from investors.

2. Phishing Scams – The scammers send a link via email or social media to capture the user’s phone or wallet cliff.

3. Ponzi Schemes / Pyramid Schemes – New investors’ money is used to pay previous investors which creates the false illusion of profit.

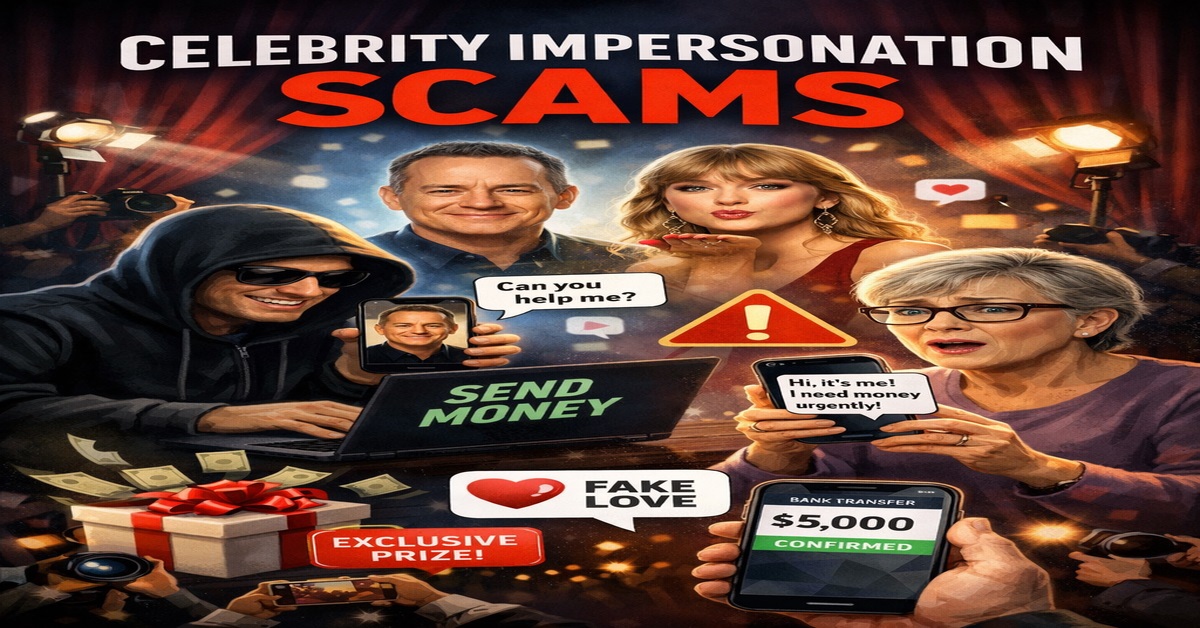

4. Impersonation Scams – The scammers impersonate cryptocurrency specialists, influencers, or representatives from a company.

As you better understand scams, you may be able to see the red flags early on and stop yourself from falling into them.

Recognizing a Legitimate Broker or Platform

It’s always wise to confirm that a broker or exchange is an authentic firm before you invest any funds. Legitimate brokers or exchanges will be regulated by a recognized authority (FCA, ASIC, CySEC, etc.) Just as in the review sites, you can see a broker or firm’s reputation, quality of service, and complaints on a broker review or rating site.

Methods of Protecting Yourself From Crypto Scams

When looking to protect yourself from scams in the cryptocurrency market, it is a good idea to enable two-factor authentication, never give your wallet keys to your wallet out, use only verified exchanges, and do not respond to or click any link sent by someone who unsolicited contacted you to offer a potential investment. Consider sending smaller amounts before you send larger, and make sure to try the withdrawal process first.

About Scams Report

Scams Report is an independent organization that exposes online investment frauds and helps victims recover lost money. Our experts have over a decade of experience tracking scam websites and maintaining a live database of fraudulent brokers.

We publish verified scam alerts, broker reviews, and recovery resources to protect traders worldwide and promote financial awareness.

Our Social Pages